Defending Our Industry

For more than 20 years, the National Cattlemen’s Beef Association Political Action Committee (NCBA-PAC) has been the political arm of the largest trade association representing U.S. cattlemen and women. NCBA-PAC raises funds from personal voluntary contributions from NCBA members and pools those contributions together to support political candidates who defend the U.S. cattle and beef industry.

Cattle producers need pro-business, pro-agriculture representatives in Congress. Individual contributions to NCBA-PAC go directly to helping candidates who support policies that benefit our industry. In close races across the country, NCBA-PAC can be the difference between a Congress that supports cattle producers or one that wants to shut us down.

Each election cycle, NCBA-PAC sets a goal of raising 1.25 million dollars ($625,000 annually). If each NCBA member contributes $25 per year, we will not only reach our goal, but we will surpass it!

Leadership

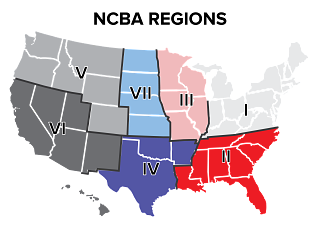

NCBA-PAC is represented across the country by PAC Generals—cattle producers who volunteer to share information about the PAC in each of the 7 regions. PAC Generals are your fellow cattlemen and cattlewomen who ensure that the PAC has the resources it needs to defend your interests in Washington.

“Thank you for standing with us to defend the cattle and beef industry. Together, we can preserve the future of our industry for the next generation.”

Will Mayfield

NCBA-PAC Chairman

Tennessee

Donnie Lawson

NCBA-PAC Vice Chairman

Indiana

A Record of Success

NCBA-PAC gets proven results. In the 2022 election cycle, 91% of the candidates supported by NCBA-PAC won their election, including several candidates with deep cattle industry roots. When you join NCBA-PAC, you are investing in the future of our industry and supporting candidates who understand that farming and ranching is more than a job—it’s a way of life.

Your fellow NCBA members understand the importance of the PAC and the work it does fighting for you. Please listen to this video from our last convention to hear directly from producers about the value of NCBA-PAC.

Join NCBA-PAC Today

Not everyone can run for public office or travel to Washington to speak with each representative and senator. You have your farm or ranch to run! NCBA-PAC is your voice on Capitol Hill and makes sure that those elected to Congress understand and care about the issues facing our industry. Few people have the resources to make large contributions to candidates for Congress, but NCBA-PAC allows cattle producers to band together, maximize their resources, and speak with one voice in support of farming and ranching.

How Do I Join NCBA-PAC?

To join, simply make a contribution to the NCBA-PAC with your personal credit card by clicking the button below or mail a check to NCBA-PAC, 1275 Pennsylvania Ave. NW, Suite 801, Washington, D.C. 20004. NCBA membership dues DO NOT go to the PAC, so to become a PAC member, you will need to make a separate contribution. Once you contribute to the PAC, you are eligible to participate in unique PAC events, receptions, and auctions.

How Long Does My PAC Membership Last?

The NCBA-PAC membership follows the yearly calendar, running from January 1 – December 31. Contributions can be made in one payment or over the course of the year in installments. Be sure to contribute today to keep your membership active!

Sponsorship Opportunities for Business

If your business supports cattle farmers and ranchers, there is no better way to gain exposure for your brand then to donate items to NCBA-PAC. The PAC holds an annual silent auction and live auction and reception in conjunction with the Cattle Industry Convention. These events regularly draw over 8,000 individuals who view auction items donated by companies like yours. Your donation to NCBA-PAC supports our efforts to strengthen the business climate for cattle producers and helps you gain publicity for your company both before and after the convention. If you would like to discuss the opportunities to benefit your company and support NCBA-PAC, please contact us today!

Contribute by Mail:

NCBA-PAC

1275 Pennsylvania Ave. NW, Suite 801

Washington, D.C. 20004

| PAC Membership Clubs | |

|---|---|

| Diamond Spur Club | $5,000 annually |

| Platinum Spur Club | $2,500 annually |

| Golden Spur Club | $1,000 annually |

| Sterling Spur Club | $500 annually |

| Dollar a Day Club | $365 annually |

| Bronze Spur Club | $200 annually |

| Copper Spur Club | $100 annually |

| Contributors Club | $25-75 annually |

Contact:

Anna Lee

NCBA-PAC

1275 Pennsylvania Ave. NW, Suite 801

Washington, D.C. 20004

202-879-9129